All Categories

Featured

Table of Contents

The are entire life insurance coverage and universal life insurance coverage. expands cash worth at an assured passion rate and also with non-guaranteed rewards. grows cash money value at a fixed or variable price, depending on the insurance firm and plan terms. The money value is not added to the survivor benefit. Cash worth is a function you take benefit of while active.

After one decade, the money value has actually expanded to around $150,000. He secures a tax-free lending of $50,000 to begin a service with his sibling. The plan funding rates of interest is 6%. He pays back the financing over the following 5 years. Going this course, the passion he pays returns right into his plan's cash money value rather of an economic establishment.

Infinite Banking Real Estate

Nash was a money expert and fan of the Austrian college of economics, which promotes that the value of items aren't clearly the outcome of conventional economic structures like supply and demand. Instead, people value cash and goods in different ways based on their financial condition and requirements.

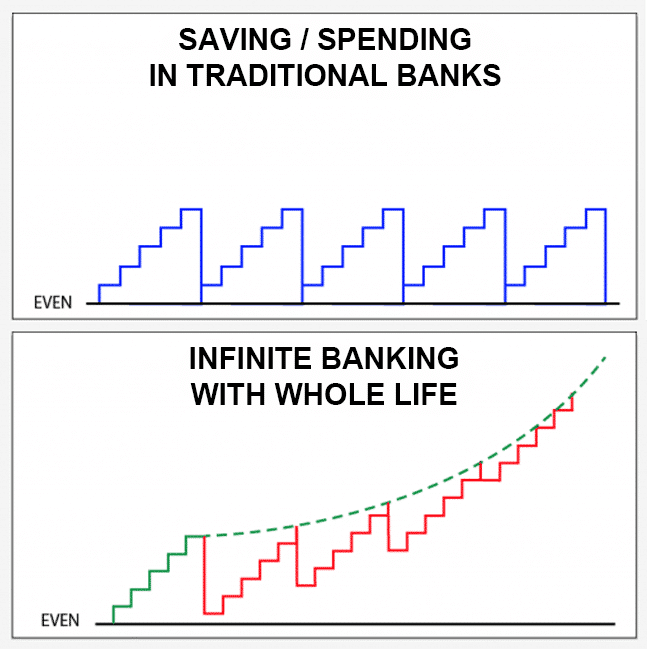

Among the mistakes of standard banking, according to Nash, was high-interest rates on finances. As well lots of people, himself included, got involved in economic trouble as a result of dependence on banking establishments. Long as banks set the interest prices and loan terms, individuals really did not have control over their very own wealth. Becoming your very own lender, Nash established, would place you in control over your financial future.

Infinite Banking requires you to possess your economic future. For ambitious individuals, it can be the finest economic tool ever. Right here are the benefits of Infinite Banking: Perhaps the solitary most valuable element of Infinite Banking is that it boosts your money circulation.

Dividend-paying entire life insurance is very reduced threat and offers you, the policyholder, a great deal of control. The control that Infinite Banking offers can best be organized right into two groups: tax obligation advantages and asset protections.

Visa Infinite Deutsche Bank

When you utilize whole life insurance policy for Infinite Banking, you participate in an exclusive agreement between you and your insurer. This privacy provides certain asset securities not located in other monetary lorries. These securities may differ from state to state, they can consist of security from property searches and seizures, defense from reasonings and defense from lenders.

Whole life insurance policy policies are non-correlated possessions. This is why they work so well as the economic foundation of Infinite Banking. No matter what happens in the market (supply, real estate, or otherwise), your insurance policy retains its worth. A lot of individuals are missing this crucial volatility barrier that assists safeguard and expand wide range, instead dividing their cash into two pails: financial institution accounts and financial investments.

Market-based financial investments grow wealth much faster but are exposed to market fluctuations, making them inherently high-risk. What happens if there were a third bucket that provided safety but also modest, guaranteed returns? Whole life insurance is that 3rd pail. Not just is the rate of return on your whole life insurance coverage policy guaranteed, your death benefit and premiums are likewise ensured.

This framework lines up perfectly with the concepts of the Perpetual Wealth Strategy. Infinite Financial charms to those seeking greater economic control. Right here are its main benefits: Liquidity and access: Policy loans provide instant access to funds without the restrictions of typical financial institution lendings. Tax obligation effectiveness: The money value grows tax-deferred, and plan loans are tax-free, making it a tax-efficient device for developing wealth.

Bank On Yourself Review Feedback

Possession defense: In lots of states, the cash value of life insurance policy is shielded from financial institutions, adding an added layer of financial safety and security. While Infinite Banking has its benefits, it isn't a one-size-fits-all option, and it features substantial drawbacks. Here's why it might not be the best approach: Infinite Banking often calls for elaborate policy structuring, which can puzzle insurance holders.

Imagine never having to worry regarding bank loans or high rate of interest rates once again. That's the power of unlimited financial life insurance coverage.

There's no set lending term, and you have the liberty to determine on the settlement timetable, which can be as leisurely as settling the finance at the time of death. This flexibility encompasses the maintenance of the financings, where you can select interest-only payments, keeping the lending equilibrium flat and manageable.

Holding money in an IUL repaired account being attributed passion can commonly be better than holding the money on down payment at a bank.: You've always fantasized of opening your very own pastry shop. You can borrow from your IUL plan to cover the first expenses of renting a room, acquiring equipment, and employing personnel.

Nelson Nash Net Worth

Individual fundings can be obtained from conventional banks and lending institution. Right here are some crucial factors to take into consideration. Charge card can give a versatile method to borrow cash for extremely temporary periods. Nevertheless, obtaining cash on a credit card is generally extremely costly with interest rate of interest (APR) typically getting to 20% to 30% or even more a year.

The tax obligation treatment of policy car loans can differ substantially relying on your country of residence and the specific regards to your IUL policy. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan fundings are normally tax-free, offering a significant benefit. Nevertheless, in other territories, there may be tax implications to consider, such as prospective tax obligations on the car loan.

Term life insurance policy just gives a death benefit, without any type of money worth accumulation. This means there's no cash money value to borrow against.

However, for loan officers, the comprehensive laws enforced by the CFPB can be seen as cumbersome and restrictive. Financing police officers typically suggest that the CFPB's guidelines create unnecessary red tape, leading to more documentation and slower loan processing. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) requirements, while targeted at protecting consumers, can cause delays in closing deals and increased functional prices.

Table of Contents

Latest Posts

How To Start A Bank

How To Be Your Own Bank

Infinite Banking Concept Reviews

More

Latest Posts

How To Start A Bank

How To Be Your Own Bank

Infinite Banking Concept Reviews